Overview:

- Importance of credit scores to individuals and companies and its relationship to financial well-being.

- Components involved in the calculation of credit scores, and how each component affects it.

- Benefits of having a credit score like better credit terms, better negotiating power, lower interest rates, etc.

- Practical tips for improving credit scores such as keeping old accounts open, paying back debts/loans on time, etc.

Consider a credit score like your financial report card, it is based on your credit history. It includes information like the number of accounts held under your name, total levels of debt, repayment history, and other factors. It is an indicator of credit worthiness of an individual. Similarly, for companies we have credit ratings.

Your credit score is referred to as a FICO (Fair, Isaac and Company) score. FICO is amongst one of the most commonly used credit scores. FICO is widely used in the US. and for India, CIBIL is widely used. It is calculated once a month, but may be updated frequently depending on the nature of use.

Calculation:

Specific calculation is not revealed by FICO, but the factors involved include:

- Payment history: It tells about how consistently you have credited your debt accounts, whether it was on time or not. Any previous bankruptcies or delays or inconsistencies in payment can impact the credit score negatively.

- Amount owed: It takes into account the maximum amount of credit you used/owed relative to the approved credit amount.

- Length of credit history: Longer credit history with no mishaps is desirable.

- New credit: Applying for new credit cards could be a sign of financial distress and negatively impacts your credit score.

- Credit mix: It helps in determining whether you have been able to manage different types of credit accounts well (i.e., Mortgages, student loans, etc)

Utility accounts are not included while calculating the credit score, but any delinquencies in these accounts can be flagged to credit bureaus. Bankruptcies can negatively impact your credit scores and fixing the score after that can take years.

Are CIBIL Scores or FICO Scores and Credit Scores the Same?

A credit score and CIBIL score or FICO score are used to assess the creditworthiness of an individual. Credit score is a wide term, whereas CIBIL score or FICO score is a type of credit score.

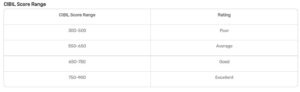

Credit scores and CIBIL scores or FICO scores are a 3-digit number, mostly ranging from 300-850 or 300-900, depending upon the credit bureau. A higher score is considered a positive signal.

Why is it Important to Maintain a Good Credit Score?

As mentioned before, credit scores are like your financial report card and it is reflective of your financial well-being. Hence, you would like it to be at best. Here are some of the benefits that you may be able to avail if you have high credit score:

- Lower interest rates.

- Better credit terms.

- Credit cards with higher credit limits.

- Lower premiums on insurance.

- More negotiating power.

Here are a Few Tips to Improve your Credit Score:

- Set reminders or standing instructions to repay loan EMIs on time.

- Clear all credit card dues on time.

- Check for errors in your CIBIL report.

- Avoid multiple credit applications in a short duration.

- Avail secured credit card.

- Refrain from closing old credit card accounts.

- Try not to use up the entire credit card limit or most of it.

- Create credit history by borrowing a mix of credit.

- Keep old accounts open.

Conclusion

In conclusion, your credit score serves as a crucial indicator of your financial health, similar to a report card. Understanding its components, such as payment history, amount owed, and credit mix, is essential for managing your creditworthiness effectively. Maintaining a good credit score opens doors to numerous benefits, including lower interest rates, better credit terms, and increased financial flexibility. By following practical tips like timely repayments and monitoring your credit report, you can enhance your credit score and secure a stronger financial future.