Overview:

- An emergency fund covers you up well in times of financial storms.

- Learning how credit works and building a strong credit score is important for low-interest loans and easier insurance claims

- Investing helps us in fighting inflation and growing wealth

- The main foundation of learning financial management is the discipline one carries

For a long period of time, fathers or spouses have been every woman’s primary source of financial security. We, as women, were never much interested in money management and financial goals as, for generations, money management was all for men. With changing times and being independent, a strong relationship between money and women is a must.

In today’s world, financial independence is as important as breathing for a woman.

After all, money makes sense in a language that all nations understand.

Today, I’ve got you covered with a roadmap including 5 major steps, which will help you understand financial literacy and financial independence in a way you never found before. Let’s dive in!

Step 1: Combine the Personal Spending And Financial Goal Plans

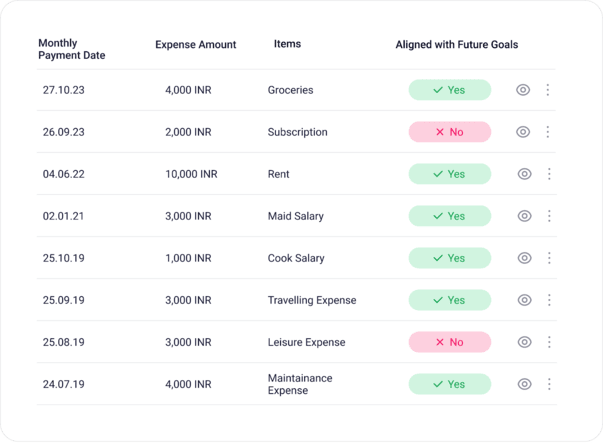

Believe it or not, every person is well aware of their income sources but doesn’t know where the money really goes. A personal spending plan is like a go-to strategy for beginners learning about money management.

You should make an expense plan that includes all major household and personal expenses.

Here’s an example.

Whenever we get started with money management, we do have a figure or some financial goals in mind, that would come under our financial goal sheet. Pairing both the spending plan and financial sheet together helps you track your progress and keeps you motivated and disciplined.

Step 2: Gather The Emergency Fund

An emergency fund is known as the money stash which is often saved by the people to cover up their distress in a financial crisis. It is meant to be used only in emergency situations like any health crisis, layoffs, recession, or family crisis.

An emergency fund converts a crisis into an inconvenience and backs you up well when you need support and safety during financial storms. It’s more like having a life-saving jacket when you are going boating.

How Does an Emergency Fund Actually Work Out?

An emergency fund is like the first step towards your financial literacy. After setting aside your monthly expenses from your non-taxable income, all the money must go inside your emergency fund.

For example, if you have a salary of 50,000/- INR and your monthly expense is 30,000/- INR, then the remaining 20,000/- INR should go to your emergency fund.

It is generally recommended to have 3 months to 6 months of reserved monthly expenses as the emergency fund. The emergency fund amount very much depends on one’s salary, financial goals, and expense figures. According to our example, the emergency fund of a minimum of 1,00,000/- INR is to be saved. This figure is like 5 months of rigorous consistency and self-control but with long-term happy returns!

The next question that arises is, What if you are living paycheck to paycheck?

In such a case, setting aside even a small amount as an emergency fund works fine. Even 1-2% of the salary to the emergency fund works fine while living paycheck to paycheck. All that matters for now is our discipline.

One most important thing to remember is that emergency funds should only and only be used in huge emergencies, not for any luxury or even basic wants.

Step 3: Get Yourself a Credit Card and Learn About Credit Scores

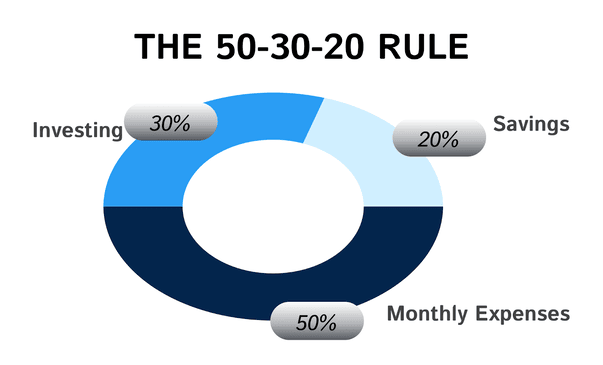

After successfully gathering the emergency fund, the next step is to follow the most basic rule of the finance industry which is: The 50-30-20 Rule.

The 50-30-20 rule suggests spending 50% of your non-taxable income on your monthly expenses. Another 30% should be spent on investing and the last 20% on savings. The catch here is to repay the credit bill at the end of the month using 50% of your salary (according to the 50-30-20 rule) and do all household expense payments through credit cards.

Our goal in this step is to get a credit card and improve our credit score without having much of a risk.

Let’s find out how!

What is a Credit Score?

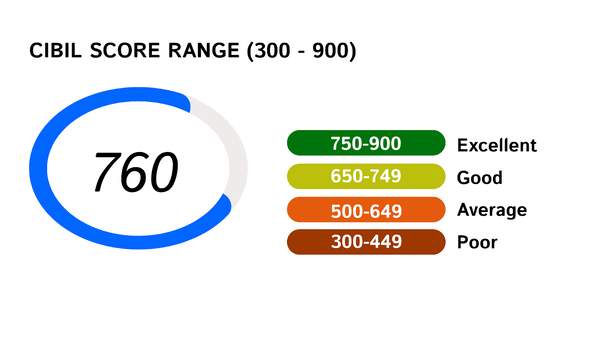

A credit score basically is a number ranging between 300 to 900 which defines the risk percentage of the lender when he lends you money for a loan. The more the score is near 900, the better it is for your portfolio. A good credit score shows your consistency in repaying your credit with utmost responsibility.

Why is a Good Credit Score Important?

Your credit score not only shows your creditworthiness but also provides perks that will make your life much easier. A good credit score can help you get a loan with low interest and has many benefits when claiming insurance.

When a person gets a new credit card or has no credit history, the credit score is marked as -1. With consistent, on-time repayments, we can increase our credit score.

How is the Credit Score Calculated?

There are major 4 credit bureaus in India namely:

- TransUnion CIBIL

- Experian

- Equifax

- CRIF High Mark

The credit score is often interchanged by the CIBIL score which is given by TransUnion CIBIL, the oldest and most profound credit bureau in India. These credit bureaus are responsible for having a record of all credit history and account management information of individuals and according to that information, it generates the credit report for each individual, which is the basis for your credit score calculation.

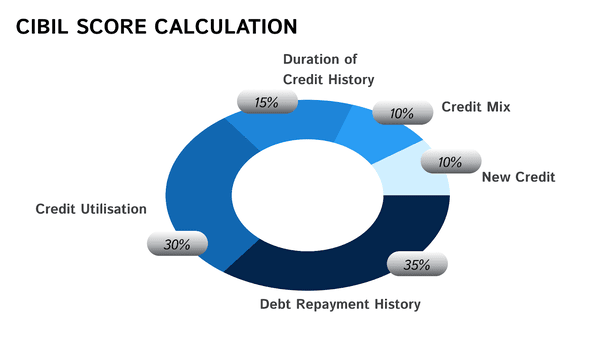

There are majorly 5 factors that affect your credit score:

- Debt Repayment History (contributes 35% weightage)

- Credit Utilization (contributes 30% weightage)

- Duration of Credit History (contributes 15% weightage)

- Credit Mix (contributes 10% weightage)

- New Credit (contributes 10% weightage)

What are the Strategies to Increase the Credit Score?

The simplest and easiest strategy is to pay all your household expenses from your credit card and then repay the credit card amount at the end of the month from your non-taxable salary (use the 50-30-20 Rule). Using this strategy, you will never be late for repayment, and your credit score and credit history will improve in no time.

It is generally recommended not to exceed your credit limit by more than 30%. It helps you increase your credit score much faster and makes you more reliable and responsible for money management. The only key thing to remember here is to not exceed your credit card limit beyond your monthly expense salary portion (which is 50% of your salary).

Step 4: Start Investing

According to the 50-30-20 rule, you should have 30% of non-taxable income for investing. Investing is the most crucial step in the Money Management Roadmap as it helps us to fight inflation and grow our money giving the best returns. Many people say that you require a lot of capital if you want to try investment but I would say that 30% of your current income will give you a good start. Always remember that gambling is not an option.

The longer you stay invested, the higher the returns you are likely to receive. That’s why, it is recommended to invest only 30% of your salary and forget about it to get long-term returns.

These returns can serve as a source of income and help you fulfill your financial aspirations in the near future. It’s just simple math, the earlier you start, the earlier you will get better results.

Which is Riskier, Saving or Investing?

Saving is generally considered as less risky than investing as there is always a fixed amount of return you will get for sure. But investing is more like a rollercoaster, you may or may not get positive returns if you are playing short-term.

When to Save and When to Invest?

People generally have a belief that investing requires a lot of knowledge and capital but that is not the case. It comes with practicing and research, and the earlier you start investing, the earlier you will enjoy great returns (when planning for long-term investment).

I believe saving and investing should go hand-in-hand, as mentioned by the 50-30-20 rule. When you do have a good amount in your emergency fund, which is like 6 times your monthly expense, then you can start saving for your leisures. It can be anything you want, such as any technical device, speakers, laptops, branded clothing, cosmetics, etc.

Why Do Some People Fail at Investing?

I feel that people generally face downfall in terms of investing because of fear, emotional biases and less confidence. In times of a volatile market, it is challenging enough to stick to our pre-planned financial strategy and investment plans. We generally become restless and fear the bad consequences but patience and discipline is the key for success.

Step 5: Expand Your Knowledge

Being a woman who doesn’t know much about finance, try to gather knowledge by different means. Read books about finance, listen to podcasts where finance advisors talk about money, and read personal blogs and finance stories.

You will feel immense confidence and learning about finance will help you tackle fear in hard times. Being so young, you always would want to spend lavishly and thoughtlessly but being disciplined and determined toward your goals will help you get immense sweet results in the future. I would suggest trying to implement loads of money management strategies and try to find out the best one that works smoothly for you aligning with your financial goals and income figures.

As far now, we are covered by our emergency fund and we know that we have to spend only 50 percent of our salary on our monthly expenses. Talking about the other 50, we are going to divide it into 30 and 20, where 30% goes to the investing portion and 20% goes to savings again.

You might wonder, If we really have an emergency fund backed up, why go for more savings? The answer to this one is that an Emergency Fund is something that keeps you backed up and also could support your family in times of need. The more you can add in your emergency fund, the more you feel financially secure and protected. The 20% portion of your savings should go to your emergency fund monthly which should only and only be touched in times of crisis.

The money management path requires extensive discipline and sacrifices but yeah, it gives fruitful results.

Conclusion:

Women’s financial confidence differs greatly based on their age and learnings during upbringing, but generally speaking, women are less confident than men in their ability to manage money, particularly when it comes to long-term objectives.

I believe that in this fast-paced world, a woman who knows about finance becomes a major support for her husband and family who are constantly fighting to achieve their financial goals to lead a smooth beautiful life ahead. Discussing financial matters with family members and husbands allows you to spend more intellectual time with them and get to know their financial problems and struggles. When a family or a husband gets a supportive daughter or wife then, she becomes an equal supportive backbone in times of financial storms.

I hope this roadmap will be helpful for you.